Selling a Business & Exit Planning

Understanding the seller's goals and the buyer's perspective is critical in mergers and acquisitions. Our people-first strategy finds the right buyer who values your employees and customers, understands your business' worth and champions your legacy.

Business Merger & Acquisition Advisors

True North Mergers & Acquisitions (TNMA) specializes in owner exits, business valuations, mergers, and acquisition services for companies with revenue between $10M and $250M and their strategic advisors.

We create a successful and seamless business transaction strategy tailored to your needs. Our comprehensive approach considers your business's critical aspects and personal and financial aspirations, ensuring an exit plan that aligns with your goals. We prioritize confidentiality and work diligently to connect you with the ideal buyer.

Our Proven QuietAuction™ Process

True North Mergers & Acquisitions begins by performing a Market Value Range (MVR) to understand at a high level how buyers will perceive the Company's marketplace value. Given the magnitude of selling your life's work, many clients engage TNMA to perform a Compass Exit Opinion™ which is a deep dive at a granular level to understand your company's value, consider market activity to determine whether now the time to sell, and to analyze the Company's differentiating values compared to similar companies, and evaluate potential transaction scenarios that maximize after-tax proceeds.

We then sell your business with TNMA's QuietAuction™, a proven, effective M&A process that generates competitive interest from multiple buyers. The result more often is a premium price with more seller-friendly transaction terms that can mitigate taxes.

"Help people first, and success will follow" - TNMA Culture Creed

Net After Tax considerations

Other costs you should consider are tax, legal & accounting fees. Suppose you decide to engage us to represent your company in a transaction. In that case, we recommend we help you secure a net after tax analysis before going to market to ensure we can steer buyers to the most advantageous tax structure for you. If your accounting professionals are not well-versed in M&A tax mitigation strategies, we can introduce you to those professionals.

Confidential, Targeted Marketing

Confidentially finding and attracting qualified buyers is essential to a successful marketing campaign. It would be great if there were a silver bullet or a one-step approach, but there is no such thing. Creating and reaching a comprehensive list of strategic buyers is a labor-intensive, iterative process.

We receive information during the confidential marketing campaign, and we use this intelligence to overcome buyer concerns and objections and to identify further niche buyers that can generate financial synergies and create new strategic opportunities.

We use a variety of sources to identify and target buyers, including past acquirers, multiple databases, confidential discussions with industry strategic buyers and private equity firms, and professionals like CPAs, business bankers, and attorneys. Strategic buyers are the hardest to reach. They are C-level people like you. Our experienced, professional team has the determination and horsepower to reach these buyers.

Telling Your Company's Unique Story

Qualified buyers will receive a Confidential Information Memorandum (CIM). The CIM tells your company's unique story, especially the value drivers and growth opportunities, to help drive premium offers.

The QuietAuction™ Creates Options and Control

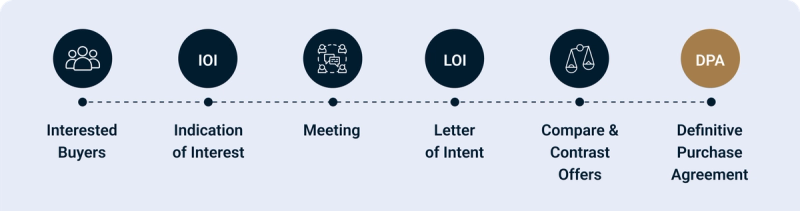

Our QuietAuction™ process is designed to drive interested buyers to an initial Indication of Interest (IOI). We then take the best offers and invite them to a management meeting where you interview them, and they ask you questions about the business.

We then ask for their "final and best" offers at a subsequent date; this is the letter of intent (LOI) deadline, allowing us to negotiate twice and create the auction dynamic. It also allows you to compare and contrast offers versus getting one at a time and wondering if you could have done better. Our negotiating tactics focus on seller-friendly terms that can increase buyer bids, increase enterprise value, and reduce tax consequences.

Full-Service firm

Our full-service firm ensures you have a customized professional investment banking strategy with personalized attention and practicality from trusted advisors, many of whom have signed both sides of the check running their own companies. We go beyond the transaction and are consultative advisors, from signing the engagement agreement to the closing table when we get paid.

Industry Expertise

Our team has deep expertise in selling lower-middle-market businesses across diverse industries. Here is a link to a manufacturing case study. This case study might be helpful to share with your partners, spouse, or other stakeholders as it best illustrates how to execute a sale using our M&A transaction process called the QuietAuction™.

Summary

Our industry experience focuses on how strategic buyers behave, and our proprietary M&A process maximizes the seller's net after-tax cash from the sale and aligns with your financial goals.

We target strategic buyers who can afford to pay more because they can realize financial synergies with the acquisition. The output of our marketing campaign provides you with multiple qualified buyers as a seller, and having options is of value. Once the optimal buyer is identified, our proactive approach to due diligence and interface with your accounting and legal team will allow us to close the sale promptly.

The goal is to find a group of buyers with high financial synergies, and then competition drives the process to maximize enterprise value. We also understand that it's not all about price. Our process gives you options and lets you select the buyer that is the best overall fit for you—price, culture, likeliness to close, transition, tax mitigation, etc.

Below is a graph that illustrates the power of the QuietAuction™ process. It always amazes us that the QuietAuction™ generates buyer offers where the highest offer is twice the lowest amount, even though everyone was given the same information before submitting their bids. The graph below illustrates a client case study where we targeted $80-$100 million enterprise value. We had many offers, negotiated each, and successfully sold the business for $120 million, a $30 million premium over the owner's initial goal.

If you have any questions about the QuietAuction™ process, or would like more information on selling your company, contact CEO Chris Jones or President Michael Hubsmith.

FAQs

Let our elite team of advisors guide you towards a better solution for your financial future.

It’s Our Culture That Makes Us Different

We Take Action

Our professional advisors bring perseverance, problem-solving, and a “get it done” attitude to the table.

Our Team Works Hard & Plays Hard

We balance a strong work ethic that brings profitable results to our clients within a culture that celebrates the process.

We’re Leaders In More Ways Than One

At True North Mergers & Acquisitions, we’re a leader to our clients, a leader in the marketplace, and leaders to each other.

We Believe in Teamwork

We bring our whole selves and work as a team to deliver world-class service to our clients.

Help People First & Success Will Follow

We’re devoted to encouraging, equipping, collaborating and uplifting all who come in contact with us.

It’s All About Servant Leadership

This is the core purpose of why we exist — placing the needs of others before ourselves. Success will follow.

Our Advisors Bring You Expertise, Market Knowledge & Industry Contacts

Meet the people of True North Mergers & Acquisitions — a team of high-caliber advisors and industry experts who will rally for you.

$10M - $250M

TYPICAL TRANSACTION SIZE

30+ M&A

PROFESSIONALS

$4B+

TRANSACTIONS CLOSED

$120M

LARGEST TRANSACTION

300+ Years

COMBINED ADVISORY EXPERIENCE

What Our Clients Say About Partnering With Us

Our advisors’ decades of experience, market knowledge, and industry expertise have proved invaluable to our clients. Here’s what they say about working with the True North Mergers & Acquisitions team.