EBITDA Multiples for Understanding Business Valuation

January 15, 2025

Before you buy, sell, or invest in a private company, it is essential to understand the company's valuation range. Since private companies often lack publicly available data, the process requires a combination of financial analysis, market research, and informed assumptions. A widely accepted way to calculate a private company's value is to determine its transaction multiple range. This range is a key factor that shapes every merger and acquisition transaction and influences the transaction price.

By understanding how to calculate and interpret the private company transaction multiple, you can make informed decisions that better align with your personal and business goals.

- For buyers, determining the multiple ranges of private company transactions helps evaluate an investment opportunity and whether a potential acquisition fits their investment criteria.

- For sellers, understanding the multiple range of private company transactions allows a business owner to assess their business's possible enterprise value range. This valuation typically occurs through a confidential and strategic process run by a sell-side investment bank, helping a business owner gauge a competitive valuation that accurately reflects the private company's real, market-based value.

This blog discusses what a multiple is, how it is determined, and the impact it has on the value of a private company during the selling process.

Understanding Multiples: A Fundamental Aspect of Mergers and Acquisitions Valuation

In the realm of mergers and acquisitions, a multiple is an essential benchmark that highlights a private company's financial performance in relation to the company's market value. The Enterprise Value-to-EBITDA (EV/EBITDA) multiple, a widely used benchmark in private mergers and acquisitions transactions, is calculated by dividing the enterprise value by earnings before interest, taxes, depreciation, and amortization (EBITDA).

The multiple-based approach to valuation is founded on the principle that businesses within the same industry should be valued comparably. For instance, if Company A, a manufacturer of widgets, is sold by an investment bank for an EV/EBITDA multiple of 6.5x, it would be reasonable to expect that Company B, a similar widget manufacturer, might be valued in a comparable range.

Mergers and acquisitions professionals frequently utilize private and public comparables, colloquially known as "comps," to determine realistic multiples for a given business. This process, often called a reality check, is reassuring for all parties, especially as market conditions fluctuate. It provides a data-driven perspective on a business's worth in the current market environment, instilling confidence in the valuation process.

How Do You Determine the Right Multiple?

Understanding the industry multiple is essential for business owners, as it provides a benchmark for assessing their company's financial health and market position. Several factors, including the company's size, profitability, growth prospects, and specific industry dynamics, influence the multiple used to evaluate a business.

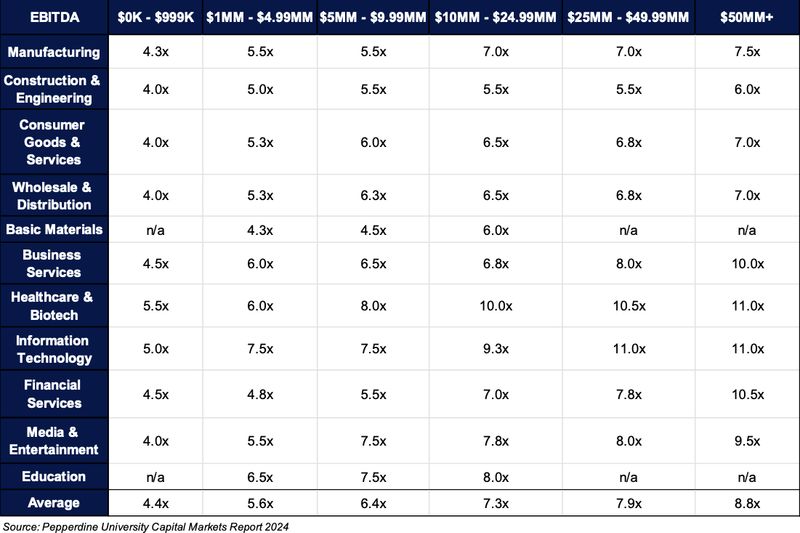

Business owners can set realistic and competitive selling prices by knowing the multiple industries. Typically, the larger the selling company's EBITDA is, the higher the EBITDA multiple that a buyer is willing to pay. This happens because companies that generate higher EBITDA tend to be perceived by buyers as less risky, more scalable, and better positioned for growth.

To better illustrate this concept, the table below, from Pepperdine University's Private Capital Markets Report 2024, displays what realistic multiples are for each industry by EBITDA size for 2024:

About Pepperdine Capital Markets Report

Pepperdine University's Private Capital Markets Report 2024 consists of a detailed look at trends in private capital markets, focusing on key benchmarks, access to capital, and economic forecasts. With survey responses from over 1,100 industry participants, including lenders, investors, and business appraisers, the report is a snapshot of the current landscape for each private capital market segment.

The Country Club Multiple

The "country club multiple" concept highlights a common misconception among business owners about private company valuations. This term describes the situation where founders mistakenly believe they can achieve the same multiples as their fellow country club members without considering all factors.

Imagine this: Larry, a successful manufacturing business owner, is convinced that his company should be valued just like Tom's, who sold his software firm to Google for an impressive 15x EBITDA multiple. Larry got this idea from a chat at the country club, and now he is aiming for that same level of success.

However, Larry's business differs significantly from Tom's in terms of industry dynamics, financial performance, and market conditions. Ultimately, the market dictates a private company's value and varies based on buyer perspectives. Different buyers assess value differently, influenced by their financial capacity and the company's perceived strategic importance and fit.

During the QuietAuction™ process, these differences become apparent as valuations fluctuate between the Indication of Interest (IOI) and Letter of Intent (LOI) stages. Additionally, private equity firms often have specific criteria influencing their offered private company transaction multiples. At the same time, strategic buyers may be willing to pay a premium for private companies that have financial and operational synergies with their existing portfolio companies or have niche market opportunities. By understanding these factors, private business owners can set more realistic expectations for their company's valuation.

About True North Mergers & Acquisitions

The team at True North Mergers & Acquisitions is dedicated to advising lower-middle market private companies and founders to achieve a competitive valuation in the marketplace, ensuring they can maximize the value of their life's work.

You can explore our case studies to learn more about who we are and the transactions we have advised on. If you're interested in further discussing your private company valuation, don't hesitate to contact Michael Hubsmith, the president of True North Mergers & Acquisitions.

Subscribe to our Newsletter

Sign up for the latest industry insights from True North Mergers & Acquisitions.